How to Account for Intangible Assets under IAS 38

Many companies incur huge costs from which they expect to benefit in the future.

For example, companies pay salaries to software engineers who develop some game or an application.

Well, how would you treat these costs?

It does not feel OK to put all salaries of these engineers in profit or loss when they are incurred, because the company will benefit from these expenses in the future.

Or, in other words, how my readers love to say it: the costs incurred now will be matched with revenues in the future.

One of the most frequent audit issues that I came across during my good old audit times was the dilemma:

Intangible asset or expense?

And, in my previous article, I covered this dilemma quite extensively with a few illustrations or examples.

But, then I received so many e-mails from you, my dear readers, asking me to cover more principles of accounting for intangibles, not only about distinguishing assets from expenses.

And yes – video!!!

So here we go. In this article, you’ll find the short summary of the main rules in IAS 38 Intangible assets and the video is in the end.

What assets are covered by IAS 38?

The standard IAS 38 prescribes the rules for accounting for all intangible assets except for the intangible assets covered by another standard.

What is excluded? Here you go:

- Deferred tax assets – covered by IAS 12 Income Taxes,

- Goodwill – covered by IFRS 3 Business Combinations,

- Intangible assets held for sale – covered by IFRS 5 Non-Current Assets Held For Sale and Discontinued Operations,

- Financial assets – covered by IAS 32 Financial Instruments: Presentation and IFRS 9 Financial Instruments,

- Exploration and evaluation assets – covered by IFRS 6 Exploration for and Evaluation of Mineral Assets,

- Expenditures for development and extraction of minerals, oils, natural gas and other non-regenerative resources, etc.

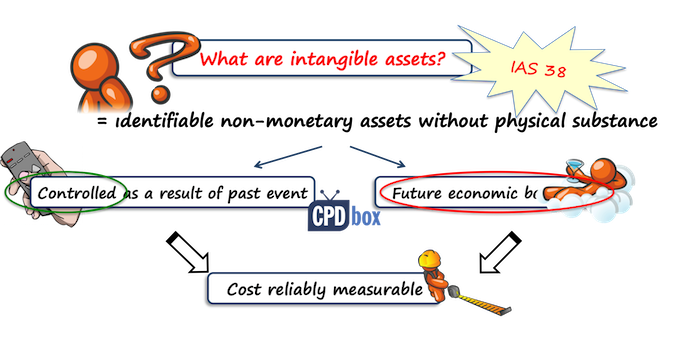

What is an intangible asset?

An intangible asset is an identifiable non-monetary asset without physical substance.

That’s the definition from IAS 38, par. 8.

People can interpret this definition in many different ways, just as they need and therefore, IAS 38 contains a good guidance on how to apply it.

Well, I wrote the full article about it, with description of every important characteristic of intangible assets and examples, so please check that out here if you need.

When can we recognize an intangible asset?

Sometimes it can happen that your item meets all the criteria and has all characteristics of an intangible asset, but you still cannot recognize it in your financial statements.

The reason for this situation could be that your item does not meet the recognition criteria.

You can recognize an intangible asset only when:

- Future economic benefits from the asset are probable;

- Cost can be measured reliably.

Again, I strongly recommend checking this article to learn more about the recognition criteria.

When you generate the asset internally…

When you actually purchase some item from someone else, it’s relatively easy to decide whether it’s an intangible asset or an expense.

Also, it’s more probable that the recognition criteria are met.

But, what about the situation when you actually develop intangible assets yourself?

Well, this area is really very complex and tricky and that’s why IAS 38 offers specific guidance for internally generated intangible assets.

Research

Research is investigation that you undertake to acquire some information knowledge or understanding.

For example, you are evaluating different alternatives for your new software product.

Or, you are examining the competing products on the market, studying their features and trying to find their weaknesses in order to design better product.

You CANNOT capitalize any expenditure for research.

You need to expense it in profit or loss as incurred.

And, let me warn you, that yes, all feasibility studies, evaluating whether the project is viable or not, ARE research and need to be EXPENSED in profit or loss.

Yes, also when you paid huge money for it.

This applies to both internal research and research conducted by the external provider, too.

Development

Development usually happens after the research phase.

At the development stage, you actually plan or design the new products, materials, processes, etc. – BEFORE the start of commercial production or use.

It is critical to distinguish development and research, because yes, you CAN CAPITALIZE the expenditures for the development.

But it’s not a free ride.

You have to meet 6 criteria before you can capitalize these expenditures.

If you are preparing yourself for some exam, then the great mnemonic to remember these 6 criteria is PIRATE:

- Probable future economic benefits,

- Intention to complete and use or sell the asset,

- Resources adequate and available to complete and use or sell the asset,

- Ability to use or sell the asset,

- Technical feasibility,

- Expenditures can be reliably measured.

Thank you, unknown genius, to inventing this pirate mnemonic, I used it at my own exam and it worked well!

You can capitalize the expenditures for development only when all 6 criteria are met – not before.

Also, you cannot capitalize it retrospectively.

Just as an example, let’s say that you incurred CU 5 000 for development in May 20X1 and further CU 10 000 in September 20X1.

If you met all the 6 conditions in August 20X1, you can capitalize only CU 10 000 incurred in September. Expenditure of CU 5 000 from May must be expensed in profit or loss.

Goodwill

Never ever capitalize internally generated goodwill.

You can only recognize the goodwill acquired at business combination, but that’s the different story (IFRS 3).

Other internally generated assets

Maybe you have created some other intangible assets, like brands, customer lists, publishing titles, mastheads or similar.

IAS 38 prohibits capitalizing these assets if created internally, because it’s hard if not impossible to measure their cost reliably.

How to measure intangible assets initially?

The initial measurement of an intangible asset depends on how you acquired the asset.

I have summarized it in the following table:

| How acquired? | How initially measured? |

| Separate purchase | Cost – see below |

| Internally generated | Directly attributable costs incurred after the asset first meet 6 PIRATE criteria – see above |

| As a part of business combination | Fair value at the acquisition date |

| By a government grant | Fair value or nominal amount + directly attributable expenditure |

| Within exchange of assets | Fair value; if not possible, then carrying amount of asset given up |

Cost of intangible asset

Cost of a separately acquired intangible asset comprises (IAS 38.27):

- Its purchase price, plus import duties and non-refundable taxes, less discounts and rebates,

- Any directly attributable costs of preparing the asset for its intended use.

I wrote a few articles about the cost of long-term assets, so you can check out this one about directly attributable cost, or this one about capitalizing assets (the part about pre-operating expenses is especially important).

What about the subsequent measurement?

Intangible assets are subsequently measured in a very similar way as property, plant and equipment.

You can chose from 2 models:

- Cost model: The intangible asset is carried at its cost less accumulated amortization (similar as depreciation) less any accumulated impairment loss.

- Revaluation model: The intangible asset is carried at its fair value at the revaluation date less accumulated amortization less any accumulated impairment loss.

Let me just add that the revaluation model is not applied very frequently for intangible assets because there must be an active market – which is rare.

And, you cannot apply the revaluation model for brands, mastheads, patents, trademarks and similar assets.

The reason is that these assets are very specific and unique and there’s no active market.

I will not deal with journal entries of amortization and revaluations, because they are almost the same as with property, plant and equipment, so please check them out in this article.

Journal entries for revaluations are covered also in the video – just scroll down and watch!

Amortization and useful life

Similarly as with property, plant and equipment, amortization is the allocation of depreciable amount of an intangible asset over its useful life.

Here, you need to decide about:

- How much to amortize, or what the depreciable amount is (cost – residual value),

- How long to amortize, or what’s the asset’s useful life, and

- How to amortize, or what amortization method you apply.

However, there’s one specific about the amortization – it is the useful life of intangible assets.

Intangibles can have:

- Finite useful life: In this case you can estimate the life of the asset up front, for example some software, or

- Indefinite useful life: There is no foreseeable limit to period over which the asset will generate cash flows, for example brands.

When you have an asset with indefinite useful life, you do NOT amortize it.

Instead, you should revise the asset’s useful life at the end of each financial year and seek for the indicators of impairment.

When to derecognize intangible assets?

You should derecognize the intangible asset either:

- When you dispose it of, or

- When no more future economic benefits are expected from the asset

.

The gain or loss on derecognition of intangibles is calculated as:

- Net disposal proceeds, less

- Asset’s carrying amount

Gain or loss are recognized in profit or loss.

Here’s the video with the summary of IAS 38:

Any comments or questions? Please leave me a message below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

58 Comments

Leave a Reply Cancel reply

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

Hope you are well. I have a question.

Can companies whose sole business is publishing contents say for example on specific domain like health and wellness (written / visual) on their website and then aims to earn revenue through selling advertisement spaces on those content pages capitalise the content writers cost as an intangible assets?

I meant the costs in creating the content as content assets. And what about if they hire freelancer to do that.

This is also intangible asset, because of publication of health related information to public through your own website and you will earn benefits from that

Hi Silvia,

Appreciated your efforts to educate us. Two questions:

(i) Do we capitalize the software license which is renewed annually?

(ii) Do we capitalize software that we subscribe to through cloudcomputing?

Hi Silvia,

For an acquired intangible assets (a license to IP) is it possible to recognize this as assets under construction if we receive the IP information over time – and it will not function to its purpose until we have received all of the information.

Br,

Robert

Hi,

I have a precise question. Let’s take an example to have a better understanding…

Context: tech company doing R&D on a specific product that they sell. They capitalize a part of their R&D in the Balance sheet, and another is expensed.

On June 2nd 2021, they sell 1 unit of product they didn’t expect to sell as early as June… and for which R&D were capitalized.

Therefore, as a very tiny revenue occurred, they are forced to depreciate the capitalized R&D.

here is my question:

At the end of the half year (30 of June), are they forced to depreciate the amount of capitalized R&D that were expected for the full year? or… do they have to depreciate only the amount of capitalized R&D for the Half Year?

Looking forward to hearing from you,

Best regards,

Laurent

Hi Laurent,

I don’t think that they are necessarily forced to start amortization when they incurred a sale. It really depends on that sale – was it sold as a finished ready-made product in a final condition as intended by the management? If not, and it was specified as a sale of some pre-finished testing item, then you can conclude that R&D on that product has not been finished yet; the sale was just incidental and the asset has still not been available for sale in the condition as intended by the management. Of course, circumstances of that sale matter – if you offered it to the wide public even as a semi-finished product, it would be very hard to justify as unintentional sale.

If you still decide to amortize because you concluded that the product was indeed in the condition as intended by the management, then it is up to you/company’s policy to decide on the method of amortization. So, e.g. if you amortize straight-line, then 1-month expense is just OK (i.e. 1-year expense divided by 12). Careful, I am talking about accounting depreciation in line with IFRS here; I am NOT talking about tax depreciation because this depends on the local tax rules and as a result, the deferred tax may arise.

I hope it helps. S.

Thanks Silvia.

Yes, the product was considered as finished. (sold to the end client).

Therefore, if I understood correctly, if the company sells 1 finished item on 1st of June 2021, they have to amortize the capitalized R&D…

Now, my follow-up question is:

Let’s consider we’re in June 30th 2021 and it’s a straight-line amortization in 4years.

As we’re on June 30th, and they sold 1 items, does the management have to amortize 6 months of capitalized R&D? or does the management have to amortize the FY capitalized R&D as of the end of June ?

I am asking these questions to understand whether the sale of 1 item had a very small contribution in terms of topline and high negative impact on the profitability as the end of the fiscal half year?

Hi Analyst,

I do understand your questions and reasoning behind them. Normally you can select units-of-production method for depreciation meaning that you would depreciate the machine based on number of units produced, but this is out of question right now since this is not the fitting situation for application of this method. Also, revenue-based methods of amortization are clearly prohibited, so yes, you are left with straight-line (or diminishing balance or similar) method of amortization.

I don’t see though why you want to amortize 6 months since the item was sold in June – that seems like amortizing 1 month only. And yes, I am very well aware that you would be in a loss position in that year.

All the best

S.

how to solve this

Q2. Abena Co began a research project in October 20X3 with the aim of developing a new type of machine.If successful, Abena Co will manufacture the machines and sell them to customers as well as using them in their own production processes. During the year ended 30 June 20X4, costs of $25,000 were incurred on conducting feasibility studies and some market research. During the year ended 30 June 20X5, a further $80,000 was incurred on constructing and testing a prototype of the machine.

Required:

Write the journal entires for the above transactions.

Hi Silvia. I have the same dilemma. Do you have an update here?

Feasibility studies and market research meet the definition of “research”, not “development”, and that is never capitalized, but expensed. So the entry would be Debit P/L – research expenses and Credit Bank accounts/Suppliers/Whatever suitable with 25 000.

For the development cost during 30 June 20×5 – that meets the definition of “development”, but you can capitalize development only if all 6 “PIRATE” criteria in IAS 38 are met – which is unclear from the question when they were met. Assuming they were met, the entry is Debit Intangible assets and Credit Bank accounts/Suppliers/Whatever suitable – 80 000.

Hi, is customising an off-the-shelf software for the company’s own use considered an internally generated intangible asset? Thank you.

Hi, i have a question, How we calculate amortization Expense if a development cost of Rs, 650,000 of internally developed formula was capitalized in current year with estimated useful life of 8 years, Half of the cost include salaries to researchers?

Hi Silva,

I was hoping you could guide me with regards to accounting for an e-book. The e-book is sold in the ordinary course of business. As I understand this is not included as an intangible asset but rather as Inventory in terms of IAS 2. However, I am having trouble with how this would be accounted for, for instance what is the cost of the ebook for the company? As the ebook can be sold indefinitely what is the value of the asset to the company?

Thank you so much.

Book is tangible asset because you have physically managed in inventory. So you can post as tangible assets in your balance sheet.

What are the Current issues of internally generated intangible assets

Hello Ma’am,

Content very nicely drafted, but I have a query.

Incremental amortization due to revaluation increase needs to be transferred to Retained Earnings. Can you explain me logic behind this, because I am of the view that we do revaluation to reflect true value of asset & as entity uses asset, its amortisation charge should hit P&L as per conservatism to some extent. I am really confused on this issue, please guide.

Regards, Dipesh

Hi Silvia,

How to Account for Intangibles under Cloud Computing Arrangements where we purchase the Software on Subscription basis ?

Hi Silvia,

When determining overheard that is directly attributable to internally generated intangible assets (development costs), how do you recommend allocation? For example, the engineering staff working on the development sits on the 2nd floor of our 4 level building. We would not need to rent that part of the building if we did not have those engineers. How do I allocate the rent directly attributable to their development activites? Am I pushing it to try to allocate other overhead, such as utilities?

That’s OK to allocate I think. It is a marginal cost (incurred due to development), so yes, it is directly attributable. S.

Hello Silvia, A company purchase a software for use in 2017 for let say 2m, at what amount should it be measured in 2020.

If you apply cost model, then cost less accumulated amortization.

Hello Silvia,

We are shortly entering a phase of implementation of new ERP.

This will be off the shelf solution (SAP), but it will require significant customization for our needs, during which significant resources will be deployed and a large amount of expenditures will be incurred (different locations, so a lot of travel expenditures, employee allowances, etc.).

There is no doubt about the license itself and the work charged by the SAP consultants, these will be recognized as Intangible asset.

But what about company’s employees’ expenditures (as described above), are they considered as directly attributable and should they be recognized as part of this intangible asset?

Regards, Mark

Hi Mark, well, have a go on this article, it relates to PPE, but applies to intangibles, too. S.

Hello Silvia,

Would you capitalize the costs incurred (labor) from the hand off from Engineering to Production Engineers to see if the product can be commercially produced? What about the labor it takes to set up a new production line to build the newly developed product – where would you account for that. We are in this gray zone between engineering actually being done developing and production being able to commercially produce because we are finding issues while building that Engineering needs to go back and fix.

Also the company paid salaries for certain employees who work for this new location to bring the site into use. Can they capitalize these salaries in accordance with IAS 38?

Not in accordance with IAS 38 – only if they can be directly attributed to the specific item of property, plant and equipment under IAS 16.

Dear Silvia

During opening new business facilities (new location) and the company paid rent of the site (building) in order to prepare the needful of this new location . Can the rent be capitalize along with other cost as start up (pre operating cost) in line within IAS 38? Many thanks

No.

Hi Silvia, nice job!

A question, how would you decide if the software licenses bought and paid over the last periods is under IFRS 16 or IAS 38?

thanks !

Hi our company is a not for profit organisation which provides membership to our customers . We have a website through which customers can select the type of membership they would prefer. So in this case, shall i book the website as Fixed asset or Intangible asset or expense it out as and when cost paid incurred ?

assume we have a drug store and we are developing a new drug to sell it. under this development we are using half of building for 1.5 year. so could you advise me if we can capitalize the depreciation amount for this building.

Yes, during the development stage, if the building (or its half) has fully been attributed to this project.

Can you advise the appropriate accounting treatment of pollutant ‘cap and trading’ schemes that in some jurisdictions are recognised as Intangible Assets and seemingly are accepted as being compliant with IFRS

Yes, these environmental quotas mostly meet the definition of an asset under IFRS and intangible asset under IAS 38 because they are separable. Thus you can capitalize it and amortize over the term of the quota.

how to solve this one ! x1 ,zzz acquired a franchise for rm 400,000. expected 8 years. entity adopt the revaluation model. dec x2, fair value franchise was rm 420,000 and dec x4 it was rm 170,000. discuss the accounting treatment . please help me to solve this one.

Thank you for sharing your expertise, Silvia.

hi,

Is mobile application is an intangible asset and should capitalized the development cost.

An intangible asset is identifiable when it:

– is separable (i.e. capable of being separated or divided from the entity and sold, transferred, licensed, rented or exchanged wither individually or together with a relate contract, asset or liability), or

– arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.

ACCA specimen exam paper states that IAS 38 prohibits treating intangibles sold not as part of ordinary business activities as revenue to PorL. But is doesn’t elaborate and I can’t find this mentioned anywhere else the the literature for this subject- and it contrary to what you say on the subject. Can you please help me understand this?!

Hi Claire, can you give me the link or quote precisely? The standard IAS 38 says that if you sell the intangible asset not as a part of ordinary business (side note – if you sell the intangible asset within the ordinary course of business, then IAS 38 does not apply at all, but IAS 2 – inventories), then you recognize the “profit on sale” in profit or loss for sure. It is in the paragraph 113 of IAS 38. However, you do NOT present it as revenue (i.e. not among the main items of profit or loss as the revenue from operations), but as a gain somewhere else, among “other” items within profit or loss. I hope this answers your question.

ACCA SBR Specimen Exam 2 – “IAS 38 Intangible Assets explicitly prohibits classification of a gain on derecognition of an intangible asset as revenue”. I was taking this as not to PorL, but wasn’t sure where to put it?

I repeat from my previous response – you put it to profit or loss, but you will not classify it as revenue, but as a gain.

Hi,

shall we recognize amortization cost of intangible assets as part of production cost or charged as an expenses directly into p&l account?

It depends – if they are directly attributable to some other asset, then you can capitalize.

Hello Jane, the cost of the franchise in the franchisee book can be at zero cost or you can use the fair value of the franchise assuming you are to pay for it, that is what others pay for the cost…….In accordance with IAS 20.

Hi, I would like to ask a question.

Let say if the license is not being sold but kinda like leasing it (like the supplier gave license for a period of time) should we recognize it under IAS 38 or can we put under IFRS 16?

Is there a possibility to recognize the strategy design costs incurred as Intangible asset?

Is their any guidelines/standards for reporting revenue generated from IP assets.

The IP assets should be accounted for under IAS40 and the REVENUE should be accounted for under IFRS15

Dear Siliva,

our company got a franchise for cookies, and we have to pay no fee to the franchisor for the franchisee itself.

How should we account for the franchise?

Thanks!

Dear Silvia,

We are preparing to to audit a Software Company that develops and license banking software, which is the main revenue generator. I have studied the financial statements, but I did not see the asset (software) reflected in the statement of financial position. My thinking is that there should be some intangible asset recognised in the Balance Sheet.

My question is how and where should the asset be recognised in the financial statement and at what value? I will appreciate your guidance on this. Thanks

Good analysis me and those Wo have problem in Ifrs accounting and reporting can you tell about suffered tax and finance lease Ifrs 16

Hi Muhammad,

yes, sure, there are troubles with IFRS 16, but I think I covered this standard a lot on this website, just browse!

Hi, Sylvia,

Can you please kindly give guidance on the following.

During the year there has been an acquisition of a company that holds a mining license, which has not been previously recognised by the Company. The Company adopted IFRSs after the date when the ownership has changed. All other assets and liabilities have been transferred to the initial owner by means of separation and forming another legal entity which has been registered by the state authorities. As a result, the Company remained with a mining license, very small amount of PPE and liability to the State Budget. If considered from the point of view of IFRS 3, it’s an acquisition of a mining license, not a busiiness. If the parent recognises this mining license in its consolidated financial statements as an intangible asset at fair value on the date of acquisition as deemed cost (based on the valuation report provided by an independent professional valuation body), can the Company recognise this item in its separate financial statements as an intangible assets as well? If not is there any other way of reflecting this license in the separate financial statements. For instance, using the exception of IFRS 1 and recognising is upon first-time adoption at fair valuation as deemed cost? I know that the most questionable issue here is the existence of the active market, but the thing is that country where the Company is operating is a small micro market, with only 25-27 mining licenses for the last at least 5 years, and annually 1-2 acquisitions of mining companies (but actually License) take place? Can this be a justification for a frequency of transactions?

I’d be more than grateful if you could provide some more information on this topic.

Thank you in advance.

Hi Tatevik, interesting question. I am assuming that the acquired company still remains the legal entity and there is no direct transfer of assets from the acquired company (subsidiary) to the parent. In this case, my answer is no, the parent can not recognize the mining license in its separate financial statements. Here, we are talking about the acquisition of a subsidiary that is NOT a business, therefore you are right in saying that you do not apply the acquisition method under IFRS 3 in the consolidated financial statements, however under IFRS 10, you must consolidate that company since you control it even if it does not constitute a business. The difference is that here, goodwill does not arise, because you need to allocate the cost of investment between the individual identifiable assets and liabilities in the group based on their relative fair values at the acquisition date. But, NCI can still arise (not in your case since the parent purchased all of it).

As for the separate financial statements, you should follow IAS 27 that requires to present the investment in a subsidiary either at cost, or in line with IFRS 9 as a financial instrument or by the equity method. So, the parent will not show individual assets in its separate financial statements, but the investment in a subsidiary. Another argument is that the asset is basically resource controlled by the entity and per se, the parent does not control mining license directly here, as it was issued to its subsidiary. So, while the parent controls subsidiary (which is reflected in the consolidation), the subsidiary controls the mining license and thus it is shown in the separate financial statements of that subsidiary.

Thank you so much, Sylvia!

One last question please, in this case is the existence of an active market must? And does active market necessarily mean that the non financial item is necessarily classified to fair value level 1? Because the license valuation has been made with perception of Level 3 fair value.

Thank you so much in advance.